Canada’s Economy Grew by 1% in the Third Quarter

The Canadian economy experienced a sixth consecutive quarter of shrinking on a per-person basis due to higher interest rates impacting business investment. Statistics Canada’s gross domestic product report showed an annualized rate of 1% in the third quarter, down from 2.2% in the second quarter. This figure is in line with economists’ expectations but lower than the Bank of Canada’s October forecast of 1.5%. Growth on a per capita basis fell 0.4% in the quarter.

Economists are divided on whether the Bank of Canada will cut its key interest rate by a quarter or half a percentage point at its meeting next month. TD director of economics James Orlando believes that the momentum in the economy should be sufficient evidence for the Bank of Canada to scale back the pace of cuts. CIBC senior economist Andrew Grantham believes the weaker growth justifies a larger cut, although next week’s employment figures are still likely more important in making a final determination.

The central bank’s key interest rate currently stands at 3.75 per cent. However, household net savings increased as disposable income grew at double the rate of spending. The report said high wages and lower interest rates helped the household savings rate hit a three-year peak in the third quarter, reaching 7.1%. This continued acceleration in the savings rate suggests Canadians continue to save cash for mortgage renewals in 2025 and 2026.

Source: Financial Post

Source: Globe and Mail

Source: Statistics Canada

Source: Statistics Canada

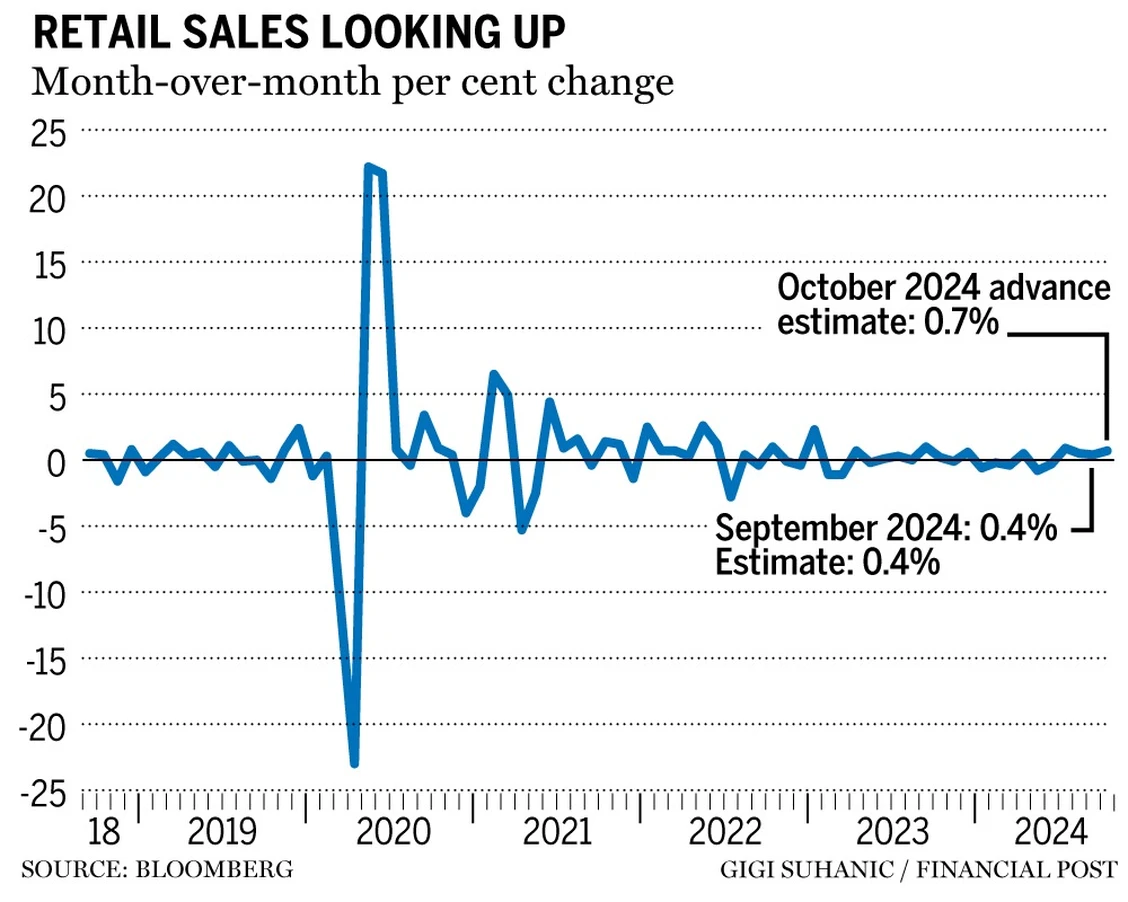

Rebounding Retail Sales Show Lower Interest Rates Are Working

Canadian retail sales increased by 0.4% to $66.9 billion in September, driven by gains at supermarkets and other grocery stores, according to Statistics Canada. The agency also reported an advance estimate for October suggesting sales increased 0.7% for that month, though the figure could be revised.

The Liberal government plans to waive GST on prepared foods, alcohol, books, and toys over winter holidays, and distribute $250 checks to 19 million Canadians. The stimulus package is expected to further fuel consumption in the fourth quarter and into next year.

The Bank of Canada has cut its policy interest rate four times this year to bring it down to 3.75%, as the annual pace of inflation eased 2.0% in October. Food and beverage retailers saw a 3% increase in sales, while supermarkets and other grocery retailers rose 3.3%.

The building material and garden equipment and supplies dealers sub-sector also saw a 3.0% increase. However, gasoline stations and fuel vendors saw a 2.3% fall, while volume sales increased 3.2%. Motor vehicle and parts dealers saw a 0.7% drop.

Core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers, gained 1.4% in September.

“Canadian consumers seemed to have found their footing in the second half of the year, benefiting from cooling inflation and falling interest rates,” BMO economist Shelly Kaushik wrote in a report.

Source: Financial Post

Source: Globe and Mail

Source: The Star

Source: Statistics Canada