Canadian Home Sales Up Again in June, National Prices Holding Steady

June Highlights:

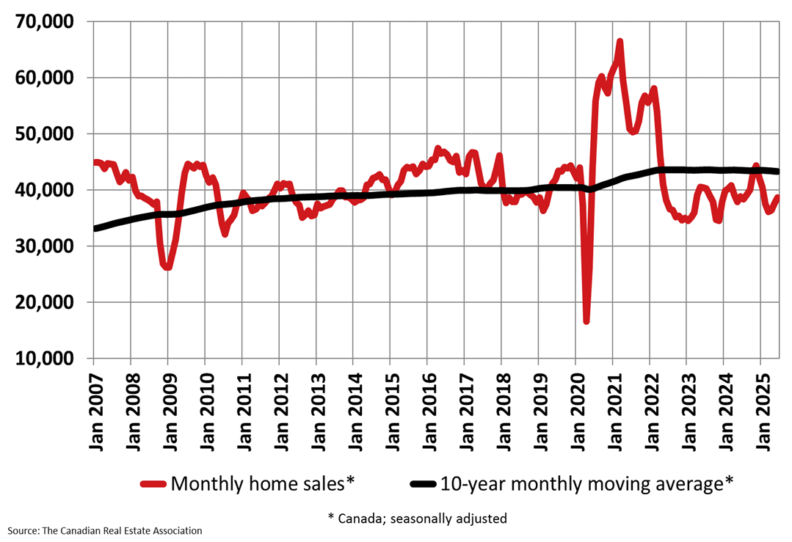

- National home sales were up 2.8% month-over-month.

- Actual (not seasonally adjusted) monthly activity came in 3.5% above June 2024.

- The number of newly listed properties fell 2.9% on a month-over-month basis.

- The MLS® Home Price Index (HPI) was almost unchanged (-0.2%) month-over-month and was down 3.7% on a year-over-year basis.

- The actual (not seasonally adjusted) national average sale price was down 1.3% on a year-over-year basis.

The Greater Toronto Area (GTA) has seen a 17.3% increase in sales activity over the past two months, with transactions remaining historically low. The national sales-to-new-listings ratio rose to 50.1% in June, up from 47.3% in May, and the long-term average is 54.9%. The number of properties listed for sale on Canadian MLS® Systems increased 11.4% year-over-year to 206,435 properties at the end of June 2025, just 1% below the long-term average for that time of the year.

New supply declined by 2.9% month-over-month in June, but the national sales-to-new-listings ratio rose to 50.1%, up from 47.3% in May. Valérie Paquin, CREA Chair, warns that delayed activity in Canadian housing markets could surface this summer and into the fall if the spring market was mostly held back by economic uncertainty.

At the end of June 2025, there were 4.7 months of inventory on a national basis, slightly below the long-term average of five months. The National Composite MLS® Home Price Index (HPI) was little changed from May to June 2025, with a 3.7% decrease compared to June 2024. The non-seasonally adjusted national average home price was $691,643 in June 2025, down 1.3% from June 2024.

Source: CREA

Source: Globe and Mail

Source: CREA

CREA Updates Resale Housing Market Forecast Amid Continuing Economic Uncertainty

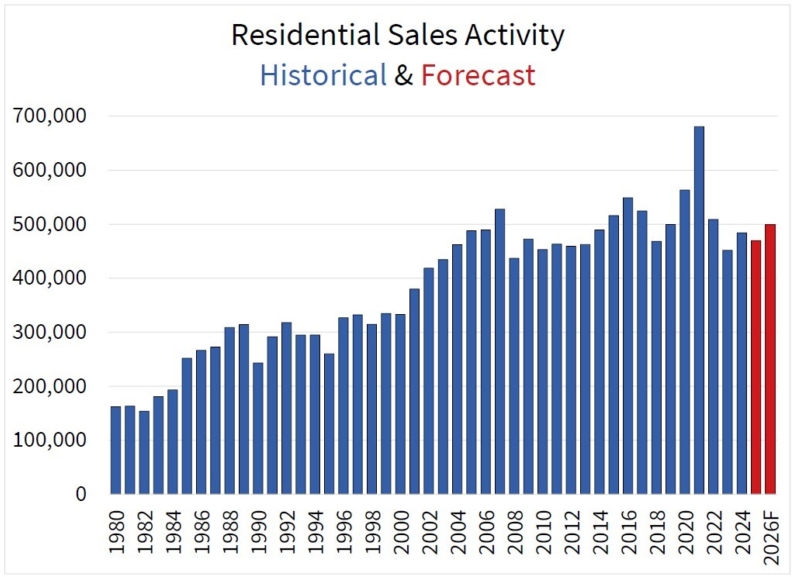

The Canadian Real Estate Association (CREA) has downgraded its forecast for home sales in 2025, despite the possibility of a turnaround following increased activity in June. The association reported that the number of homes changing hands across the country in June rose 3.5% compared to a year ago, and Canadian home sales last month also increased 2.8% compared with May on a seasonally adjusted basis. In its outlook, CREA now expects a total of 469,503 residential properties to be sold this year, a 3% decline from 2024. In April, the association forecasted the number of home sales for 2025 to remain essentially unchanged from last year, which itself marked a steep cut from its January forecast of an 8.6% year-over-year increase.

The national average home price is forecast to fall 1.7% on an annual basis to $677,368 in 2025, which would be around $10,000 lower than predicted in April. CREA senior economist Shaun Cathcart said that despite a “chaotic start to the year,” the latest data suggests the housing market rebound originally forecast for this year—before it was upended by the Canada-U.S. trade war—may have only been delayed by a few months.

The tariff-related uncertainty that drove so many buyers back to the sidelines earlier this year ended up taking a larger bite out of activity in B.C., Alberta, and Ontario than was expected three months ago. However, the good news is markets appear to be entering their long-expected recovery phase, fuelled by pent-up demand, lower interest rates, and an economy that is expected to avoid worst-case tariff scenarios.

CREA now forecasts national home sales in 2026 to improve by 6.3% to 499,081, putting activity back on track with what was expected in its April forecast, when it predicted a 2.9% gain in sales next year. The national average home price is expected to increase 3.5% from 2025 to $697,929 next year.

The number of newly listed properties throughout the country was down 2.9% month-over-month from May. A total of 206,435 properties were listed for sale by the end of the month, up 11.4% from a year earlier and just 1.4% below the long-term average for this time of the year.

BMO senior economist Robert Kavcic said there are three major factors still holding back the housing market, including a “sluggish” job market being aggravated by the trade war. With the Bank of Canada holding its key policy rate steady, mortgage rates of around 4% are not low enough to improve the affordability calculus in a demand-sparking way.

Annual Pace of Housing Starts in June Up 0.4% From May

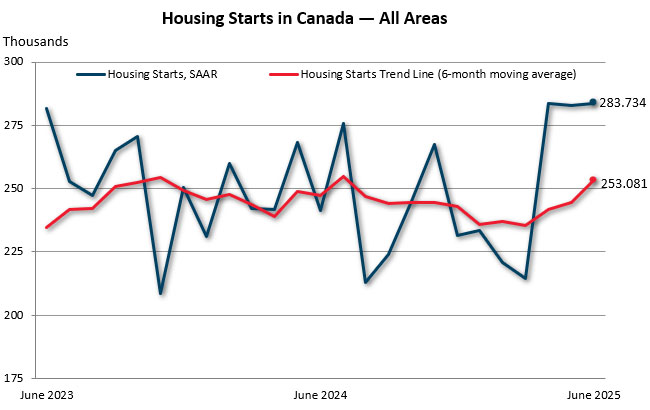

Canada Mortgage and Housing Corp. reported a 0.4% increase in the annual pace of housing starts in June compared to May. The seasonally adjusted annual rate of housing starts reached 283,734 units, up from 282,705 in May.

The rate of starts in cities with a population of 10,000 or greater was 261,705 units in June compared to 260,947 in May. The annual pace of rural starts was estimated at 22,029 units.

The actual housing starts in centres with a population of 10,000 or greater amounted to 23,282 units in June, up 14% from 20,509 in June last year. The six-month moving average of the seasonally adjusted annual rate of starts across Canada rose 3.6% in June to 253,081.

Source: Globe and Mail

Source: The Star

Source: CMHC

Eliminating Interprovincial Trade Barriers Would Add 30K Annual Housing Starts

Canada could add 30,000 more housing starts annually by eliminating interprovincial trade barriers, pushing the total number of annual housing starts close to 280,000 over time. This would represent a “meaningful step towards fixing Canada’s housing supply gap,” according to a report by Canada Mortgage and Housing Corp. (CMHC). Chief economist Mathieu Laberge said that to achieve this, Canada must reduce interprovincial constraints holding back west-to-east transportation infrastructure, which would help maximize the use of domestic materials across the country.

Removing the barriers creates general economic wealth that would make it easier to trade across partners in a country, raising the economy and making it stronger overall. This would benefit housing construction as a result. The report’s projections would represent close to 15% of the additional housing supply needed annually over the next decade to return to pre-pandemic affordability levels, according to recent CMHC estimates.

Last month, CMHC said up to 4.8 million new homes will need to be built over the next decade to restore affordability levels last seen in 2019 based on projected demand. That would mean between 430,000 and 480,000 new housing units are needed per year across the ownership and rental markets by 2035, around double the current pace of home construction in Canada. CMHC projects an average of 245,000 starts annually over the next 10 years under current conditions.

Eliminating interprovincial trade barriers was a focal point of Prime Minister Mark Carney’s campaign during the spring federal election, when he vowed to create “free trade by Canada Day.” His government has since passed Bill C-5, an omnibus bill that reduces federal restrictions on interprovincial trade while speeding up permitting for large infrastructure projects.

The Canadian Federation of Independent Business has estimated that existing internal trade hurdles cost the economy some $200 billion a year. Trade barriers that prevent the movement of either resources or labour in the residential construction industry, such as different standards for different inputs, can lead to a significant share of domestic production being redirected towards residential construction in Canada.

Source: The Star

‘From Bad to Terrible’: Toronto’s Market for New Condos Has Fallen off a Cliff

Toronto’s pre-construction condo market has worsened in the second quarter, with sales sliding to their lowest level in three decades. The lack of buyers for new condos has led some developers to delay or cancel planned projects, as they typically need to sell at least 70% of a project to qualify for construction financing. Urbanation Inc. reported that there were 502 sales of new condos in the Toronto and Hamilton area in the quarter ending June 30, down 10% from the first quarter of this year and marking the lowest activity since 1993.

Developers have already postponed or shelved numerous projects since the country’s real estate market started slowing in 2022. In the past quarter, only three projects with a total of 891 units were launched, which is 86% lower than the 10-year average for the second quarter. Investors, who used to account for at least 70% of the pre-construction condo sales, are no longer interested due to many of their purchases being money-losing investments.

Buyers have been having a hard time closing on their purchases because their properties are worth less than what they agreed to pay in earlier years. Lenders typically only provide a mortgage based on the current value, not the price that the buyer agreed to pay. Because appraisals are coming in 10% to 30% below a condo’s original selling price, the buyer has to come up with the difference.

Urbanation research shows that the vast majority of condos ready to be occupied in the second quarter were pre-sold at an average price of $1,187 a square foot. By comparison, resale prices in newly built condo buildings averaged $903 a square foot, down 24% from the original price. This shortfall is one reason some buyers are defaulting on their purchase agreements. If a buyer is unable to close, the developer has to try to sell the unit again or keep it on its books.

Investors who are able to close are facing their own issues, burning through cash every month because they either can’t find a renter or the rent they are charging is not enough to cover their condo fees and mortgage payments. The residential development industry has been hit hard by the slowdown, with prominent companies such as Mattamy Homes, Great Gulf, Rennie & Associates Realty Ltd., and MLA Canada Realty cutting jobs.

Source: Financial Post

Source: Globe and Mail

Canada Is Building Lots of Rental Housing—And Losing Interest in Condos

National housing starts in Canada have held up better than expected despite a challenging economic environment, partly due to the growth of rental units. From June to December, there were approximately 108,000 rental unit starts across the country, nearly double the number of condo units. This growth began in the 2010s due to high rental rates in urban centres and strong immigration.

The federal government takes credit for this change, citing initiatives like the Apartment Construction Loan Program and Ottawa’s decision to scrap the GST from new purpose-built rentals. This has made building high-rise rentals more cost-effective than high-rise condos. Some cities, like Toronto, have also started offering lower development charges on purpose-built rentals compared to condos, changing the relative economics of projects. Many of Canada’s major cities have seen rents and home prices drop, offering relief from years of hefty increases.

Source: Globe and Mail

Homebuilders Navigate Higher Material Costs, Uncertain Supply Chains Amid Trade War

The Canadian homebuilding sector has been facing significant challenges due to the looming tariff war between Canada and the US. With stakeholders aware of the need to rapidly scale up housing supply and improve Canada’s housing affordability gap, blanket tariffs and more targeted material-specific levies have added additional unwelcome obstacles to overcome. This includes a potential need to slow down the pace of construction as supply chains shifted and key construction parts became more expensive.

Geranium Homes, a residential developer in southern Ontario, is now increasingly sourcing materials made in Canada, such as brick and stone, and doubling down on products typically imported from other countries besides the U.S., such as steel, which it sources from countries including South Korea, Portugal, and China. However, some materials simply cannot be replicated in domestic or other international markets. For instance, a component in the layered glass windows used by Geranium continues to be sourced from the U.S. due to patent issues. The company has essentially decided to eat the extra costs.

Among products hit hardest by the trade war, Canadian Home Builders’ Association CEO Kevin Lee highlighted appliances, interior doors, and carpeting. Builders have looked for substitutions to their typical input materials, such as moving to vinyl plank or stockpiling materials to avoid potential shortages later on. The roller coaster of tariff developments has made it “impossible” to plan ahead.

Altree Developments had forecast a three to five percent hit to its overall budget with early concerns about the effects of the trade war. However, that figure has since decreased due to more Canadian material being available than first anticipated.

The Canadian Mortgage and Housing Corp. predicted a trade war between Canada and the U.S., combined with other factors such as reduced immigration targets, would likely slow the economy and limit housing activity. As of June, year-to-date housing starts totalled 114,411 across regions with a population of 10,000 or greater, up four percent from the first half of 2024. However, a regional analysis shows provinces with industries more exposed to tariffs are experiencing a slowdown, with Ontario’s housing starts dropping around 26% to date year-over-year, while B.C. has seen an 8% decline.

In Ontario, five of the 10 most tariff-impacted cities also recorded an increase in mortgage arrears during the spring. Laberge said the trade war, or associated macroeconomic factors, likely prompted layoffs in those regions, meaning people couldn’t pay their mortgages. He expects this will eventually translate to a lower number of homes being built.

The industry is already noticing these effects, with 87% of builders stating they have concerns about the well-being of their business over the next 12 months. Around 35% said they have had to recently lay off workers and have no current plans to rehire, up from 21% a year ago.

Source: The Star

Ontario Is Falling Behind in New Housing Construction, and That’s a Problem

Ontario, Canada’s most populous province, is facing a slowdown in residential construction, with other less populated provinces catching up. Construction began on 60,236 seasonally and trend-adjusted annualized dwellings in June, while Alberta and Quebec have accelerated residential construction. Québec is trailing behind with 58,849 seasonally and trend-adjusted annualized starts. This is concerning for policymakers in Ontario, as Alberta is building almost as many homes as Ontario, which has a population more than three times the size of Alberta’s.

In a functioning housing market, new construction tends to align with population growth. Larger provinces, which attract more people and businesses, should theoretically lead in housing development. However, evidence points elsewhere, with Alberta and Quebec accelerating residential construction, while Ontario and British Columbia appear to be stuck in a lower gear.

A large increase in new residential construction was recorded in June in British Columbia, but when adjusted for the six-month trend, the sharp increase still leaves British Columbia’s starts behind the other three populous provinces. This shortfall has long-term implications for affordability, as homeownership remains out of reach for many mid-income households, particularly in Ontario and British Columbia.

Residential construction in Ontario has been trending downward in the post-pandemic period, with much of the recent construction focused on multi-family dwellings, predominantly mid- and high-rise condominium and rental buildings. With weakening investor interest, tighter financing conditions, and increased construction costs, the pipeline for such projects has become considerably thinner. In contrast, construction of single-family homes in Alberta’s major cities has been relatively strong, with Edmonton starting work on more single-family homes in 2024 than Toronto, a city more than three times its size.

Canada needs to accelerate housing production to meet existing demand and support future economic and demographic growth. This will require streamlined planning processes, strategic public investment, and possibly new institutional arrangements to coordinate housing delivery at the scale now required. The federal government recognizes the need for more housing in Canada and has expressed the desire to double the rate of housing production to reach half a million homes per year.

Source: Financial Post