Home construction must double over next decade to restore 2019 affordability: CMHC

Canada Mortgage and Housing Corp. (CMHC) in its latest supply gaps estimate report estimates that up to 4.8 million new homes will need to be built over the next decade to restore affordability levels last seen in 2019 based on projected demand.

By province, the most significant housing supply gaps are in Ontario and Nova Scotia, the latter of which had some of the fastest-rising housing costs due to the pandemic.

The report said that between 430,000 and 480,000 new housing units are needed per year across the ownership and rental markets by 2035, around double the current pace of home construction in Canada.

A total of 90,760 housing starts have been recorded so far this year through May, and CMHC projects an average of 245,000 starts annually over the next 10 years under current conditions.

The report focuses on restoring affordability to 2019 levels, just before a surge in the cost of housing during the global COVID-19 pandemic, as restoring affordability levels seen two decades ago is “no longer realistic.”

CMHC’s deputy chief economist, Aled Ab Iorwerth, stated that while doubling Canada’s housing construction pace is possible, it requires a modernized workforce, increased private investment, reduced regulation, fewer delays, and lower development costs. He emphasized the need for innovation in construction technology and improved labour productivity. Ab Iorwerth also noted that increasing housing supply over time would help reduce house price growth.

The report suggested that increasing housing supply is “unlikely to cause financial instability because these forces take time to produce reactions.” Ab Iorwerth added the projections were calculated on a 10-year timeline for that reason.

“Housing supply will be increasing. This will start to slow the growth in house prices. Canadians will then be a little bit less keen to bid aggressively on housing … and they’ll diversify their savings into other money markets or the stock exchange or whatever. And so the pressure will be taken out of house prices.”

Sources:

Toronto Star

Financial Post

CMHC

GTA sees slowdown in home renovations as prices surge across Canada

Since 2020, renovation prices have increased the most in the Greater Toronto Area compared to 15 other Canadian cities, according to StatsCan’s Residential Renovation Price Index (RRPI). The quarterly index measures changes in prices charged by renovation contractors for a range of residential projects, including materials, labour, equipment, overhead and profit.

Renovation costs have risen more than 50 per cent nationally since 2020. However, this year shows signs of a slowdown. Renovation spending in Toronto decreased 0.5 per cent in the first quarter of 2025, due to tariff-related uncertainty.

The latest RRPI report noted renovations requiring substantial amounts of concrete and lumber saw the largest cost increases in the first quarter of this year.

Still, in 2025, it seems Canadians are more likely to “love it” than “list it.” A November, 2024, report by CIBC found nearly half of Canadians are in the process of planning, executing or completing home improvements. In that survey, homeowners reported an average expected renovation cost of $19,000 – nearly double the spend compared to 2019.

Sarah Caron, director of renovation services at the Canadian Home Builders’ Association (CHBA), notes the renovation market is a bigger contributor to the Canadian economy than new home building. “The increase is slowing, but prices to renovate have increased significantly since the pandemic,” she said. “There’s still a really healthy renovation market.”

Lately, renovation price growth appears to be slowing across the country due to tariff-related economic uncertainties however, lower interest rates may end up spurring more renovations.

Source:

Globe and Mail

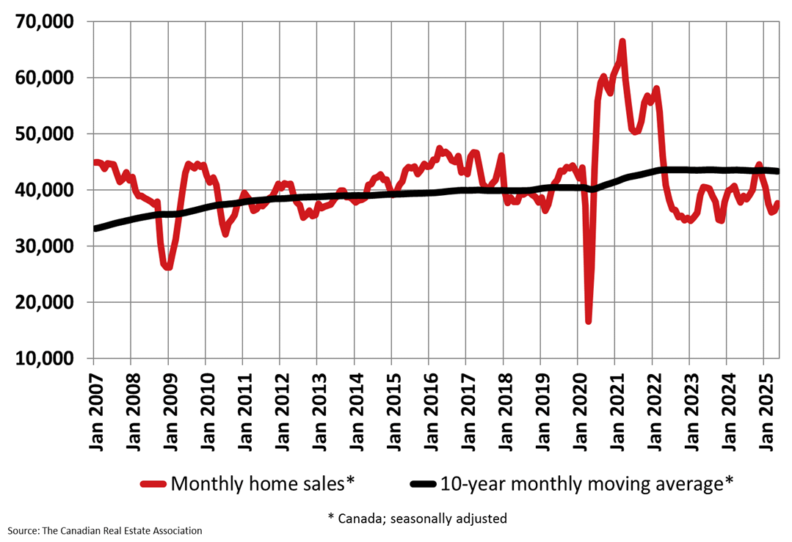

Canadian home sales rise for the first time in more than six months

Home sales rose 3.6 per cent between April and May, according to the Canadian Real Estate Association (CREA), led by sales in the Greater Toronto Area, Calgary and Ottawa. There were 37,626 home sales in May, higher than the previous month when selling activity was essentially flat after months of consecutive declines.

May Highlights:

- National home sales were up 3.6% month-over-month.

- Actual (not seasonally adjusted) monthly activity came in 4.3% below May 2024.

- The number of newly listed properties rose 3.1% on a month-over-month basis.

- The MLS® Home Price Index (HPI) was almost unchanged (-0.2%) month-over-month and was down 3.5% on a year-over-year basis.

- The actual (not seasonally adjusted) national average sale price was down 1.8% on a year-over-year basis.

“May 2025 not only saw home sales move higher at the national level for the first time in more than six months, but prices at the national level also stopped falling,” CREA senior economist Shaun Cathcart said in a release.

“At this point I’d say the market is looking like it is forming a bottom,” said CREA senior economist Shaun Cathcart.

On a non-seasonally adjusted basis, total Canadian sales fell 4.3 per cent year-over-year in May.

After three straight months of declines closer to one per cent, CREA said the National Composite MLS Home Price Index was “almost unchanged” from April and declined by 0.2 per cent in May. The non-seasonally adjusted national average home price declined 1.8 per cent year-over-year to $691,299 in May.

Properties listed for sale across all Canadian MLS systems were up 13.2 per cent year-over-year, with 201,880 listings at the end of May. CREA said that’s five per cent below the long-term average of 211,500 listings for this time of the year.

Though the resale housing market’s downturn “took a breather” in May, the bump will “likely prove short lived,” Tony Stillo, director of Canada economics, and Michael Davenport, senior economist at Oxford Economics Canada, said in a note.

The housing market was expected to recover due to lower borrowing costs and relaxed mortgage policies. However, uncertainty from the U.S. trade war has made potential buyers hesitant, fearing job loss or economic instability. Despite a slight drop, home prices remain high, keeping many buyers priced out and wary of further declines.

“Unless a deal is reached to immediately reduce U.S. tariffs, we expect a trade-war induced recession will cause Canada’s resale housing slump to continue through the end of 2025,” said Stillo and Davenport.

“Further weakening in the labour market will likely lead to more distressed home sales and weigh on demand amid still elevated unaffordability and pervasive uncertainty, pushing prices lower.”

Sources:

Financial Post

Globe and Mail

CREA

Canadian housing starts were largely flat from April to May, CMHC says

Canadian housing starts were largely flat in May 2025, with the seasonally adjusted annualized rate dipping 0.2% to 279,510 units from 280,181 in April, according to Canada Mortgage and Housing Corp. (CMHC). This slight decline was due to a marginal drop in single-family detached urban home starts, which offset a small rise in multi-unit urban construction.

The six-month trend in housing starts was flat (0.8%) in May (243,407 units), according to Canada Mortgage and Housing Corporation (CMHC). The trend measure is a six-month moving average of the seasonally adjusted annual rate (SAAR) of total housing starts for all areas in Canada.

In urban areas (cities with populations over 10,000), the annual rate was 259,804 in May, down slightly from 259,916 in April. Rural starts were estimated at 19,706 units. Despite the month-over-month dip, actual housing starts in urban centres rose to 23,745 in May, up from 21,814 a year earlier. The six-month moving average of housing starts increased 0.8% to 243,407 units. Notably, May’s housing start figures exceeded economists’ expectations of 247,500 units.

“I wouldn’t say that we’ve jumped back into a super hot market or anything like that,” said Shawn Zigelstein, a broker for Royal LePage Your Community Realty in the Greater Toronto Area.

“I think what we’re starting to see, realistically, is maybe a little bit more confidence coming back to the marketplace, seeing that we had so many … distractions in the early part of 2025 and late in 2024 that caused people to put their housing searches on hold.”

The sales slowdown that has plagued the market for much of 2025 has been attributed to potential buyers sitting on the sidelines amid economic uncertainty related to Canada’s trade relationship with the U.S.

Sources:

Globe and Mail

Toronto Star

Toronto Star

CMHC

Home prices are falling, and Canada is losing its secret weapon for stoking GDP growth

In May, home sales in the Greater Toronto Area fell 13.3% year-over-year, and home prices dropped 4.5%, highlighting a cooling housing market. Rising unemployment, which reached 7% (the highest since 2016 outside the pandemic) has contributed to missed mortgage payments and declining buyer confidence. Despite steady consumer spending for now, uncertainty remains about the housing downturn’s duration.

Economists note that weak consumer confidence and still-high borrowing costs are suppressing sales and investor activity, with interest rates unlikely to return to pandemic-era lows. Currently, five-year fixed mortgage rates hover around 4%, up from about 2% during the pandemic.

Experts argue that the housing sector can no longer prop up the economy as it did during COVID-19, when residential investment peaked at 10% of GDP. Over-reliance on housing has masked broader economic weaknesses, such as low exports and business investment. With household debt now at 174% of disposable income, economist Charles St-Arnaud suggests that shifting focus away from housing could help address deeper structural issues, despite the challenges of reorienting the economy.

Source: Globe and Mail