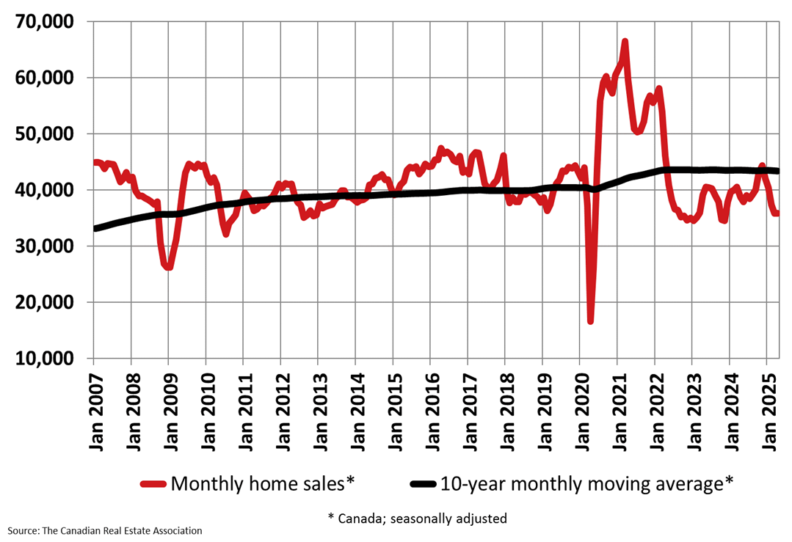

Canadian Home Sales Down Almost 10% Annually Last Month

Canadian home sales fell by 0.1% in April compared to March, with just over 35,000 homes sold across the country. The 2025 Canadian housing market is expected to return to quiet markets, with tariff uncertainty taking the place of high interest rates.

Sales declined in Alberta and British Columbia by 3.4% and 2.3% respectively from a month earlier, but Ontario posted a 1.1% increase and Quebec sales rose by 2%. Sales across the country came in 9.8% below the same month last year. In March, they fell by 9.3% over 2024, the lowest level for the month since 2009.

Anne-Elise Cugliari Allegritti, director of research and communications at Royal LePage, said home sales are expected to continue to be flat in the summer but could rebound in the fall. She added that the new Liberal government could play a key role in easing Canadians’ anxiety over the economy, U.S. tariffs, and the housing market, which would spur buyer confidence.

The number of newly listed properties fell 1% in April compared to a month earlier. The national Home Price Index (HPI) saw a decline of 1.2% in April from March and a drop of 3.6% from April, 2024. The national average sale price for homes was $679,866 in April, down 3.9% from April, 2024, after falling 3.7% in March compared to a year earlier.

TD Bank economist Rishi Sondhi said there is pent-up demand from buyers staying on the sidelines, which was already evident in Ontario and B.C. before the trade war hit Canada. If confidence improves later in the year, the market could see sales pop. However, the average home price growth in Canada will likely remain subdued for the year as supply and demand in Ontario and B.C. are readjusted.

Source: Globe and Mail

Source: The Star

Source: Financial Post

Source: CREA

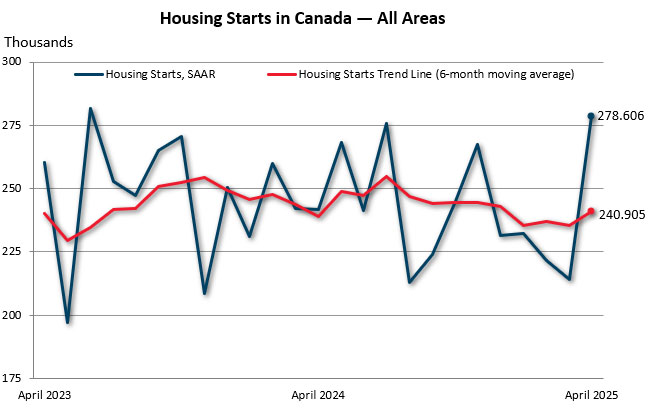

Annual Pace of Housing Starts in Canada Up 30% in April From March

Canada Mortgage and Housing Corp. reported a 30% increase in annual housing starts in April compared to March, with 278,606 units started. Urban housing starts increased by 28% to 259,788, while rural starts reached 18,818. The actual urban housing starts increased by 17% to 21,720, while the annual pace of rural starts was estimated at 18,818. The six-month moving average of the overall seasonally adjusted annual rate of housing starts was 240,905, up 2.4%.

“The increased starts activity in April was driven by increases across all housing types in Québec and the Prairie provinces, while starts in Ontario and British Columbia declined on a year-over-year basis again this month. The current economic uncertainty will have consequences for the supply and demand of new housing. CMHC will be monitoring these effects closely over the coming months,” said Kevin Hughes, CMHC’s Deputy Chief Economist.

Key facts:

- The monthly SAAR for Canada’s centres with a population of 10,000 or greater increased 28% in April (259,788 units) compared to March (202,668 units).

- The rural starts monthly SAAR estimate was 18,818 units.

- Among Canada’s big three cities, Montreal posted a 64% year-over-year increase in actual housing starts compared to April 2024, primarily driven by more multi-unit starts. Vancouver recorded a 6% increase in starts this month, also driven by higher multi-unit starts. Conversely, a decrease in multi-unit starts drove the 25% year-over-year decrease in Toronto’s housing starts compared to last April.

Builders Buy Less Land Amid Slow New Home Market

Ontario’s homebuilders have reduced purchases of new land for future residential developments, indicating a slowdown in new home construction. Altus Group data shows that in 2024, over $3.35-billion was spent on 296 deals for residential land development in the greater Toronto area, down 15% from the 349 deals in 2023, and the dollar volume falling 18% from that year’s $4.13-billion in sales. The Toronto region, once the engine of the province’s new home-building activity, has seen the sharpest drops.

So far in 2025, the market is even worse with only 47 sales in the first quarter for $398-million. That’s lower than any quarter from the last five years, the closest being the second quarter of 2020 (82 sales for $662-million) during a period of contraction amid the COVID-19 pandemic response. High-rise sites are seeing the fastest drop in price, with 239 high-density sites sold in 2022 for $4.7-billion, but 2024 saw just 152 sites (36 per cent fewer) sell for 72 per cent less cash at $1.392-billion.

Builders are pulling back on construction for sites they currently own, with Zonda Urban reporting that in the first quarter of 2025 sites representing 4,442 condo apartments had begun the starting excavation stage, which is 80% lower than the 22,253 apartments that began excavation in the fourth quarter of 2022.

Some of the transactions recorded as residential land deals are for industrial, commercial, and retail properties, but the difference is that where a few years ago much of this land would be valued at a significant premium because of its residential conversion potential, today those sites are being sold as if they are only worth a small multiple of the business income they currently generate.

Distressed land sales, which relate to land from a bankruptcy, insolvency, or power of sale process, are growing, with 23 distressed sales worth $237-million in all of 2022 and 2023 and 29 distressed sales worth $597-million in 2024. The biggest challenge for builders trying to plan ahead is the lack of certainty about what will happen in a North American economy being whipsawed by a global trade war.

The luxury condo market seems immune to these pressures, as buyers have accumulated enough wealth that they don’t view them as piggy banks for retirement. North Drive, co-founder of luxury builder North Drive, launched sales for a new 62-unit condo at 2 Post Road in Toronto’s Bridle Path neighborhood, expecting close to 50% of the units sold by the end of the week.

Source: Globe and Mail

Despite Falling Interest Rates and Prices, Home Affordability Isn’t Set To Improve Any Time Soon

Home affordability in Canada is expected to remain near historically low levels, according to the latest Desjardins Affordability Index report. The average price of a home in Canada has quadrupled over the last 25 years, while the average household disposable income has only just over doubled. The affordability index is not expected to worsen in the near-term, but many Canadian regions remain “deeply unaffordable.” Interest rates are likely to continue their downward path due to the impact of the U.S.-instigated trade war, and rising unemployment is also expected to impact households’ disposable income.

Monthly home sales figures in the first quarter of 2025 fell sharply due to economic uncertainty, and the new-build sector is expected to be hit by tariffs and retaliatory tariffs over the next two years. However, homes are not expected to become affordable in the next couple of years as prices are projected to rise in 2026. As we come out of the trade war, home prices will start to pick up again, and home sales will start to be bid on again, so affordability will deteriorate slightly next year in our predictions.

The widening gap between home prices and incomes also means prospective homebuyers take longer to save for their down payment. If households with average earnings save 20% of their disposable income in an account with 3% interest, it would take them about six years to accumulate the money to buy an average home in Canada. However, the timeline is longer for those in Ontario and B.C., where home prices are higher, about seven and seven and 7.5 years, respectively.

High rent inflation from 2022 to 2024 likely made it more difficult for would-be homebuyers to save up a nest egg. One in three renters are likely to miss a debt payment, as they have increasingly struggled with their personal finances. While the federal government has introduced policies to help households get into the door of home ownership, Norman said they could be creating more demand, which could then lead to higher prices.

Source: The Star

Ottawa Has To Allow Home Prices To Fall To Make Housing More Affordable

Housing experts are arguing against the claim that home prices don’t need to fall in order to restore housing affordability. Gregor Robertson, the former mayor of Vancouver, sparked the debate after being sworn in as housing minister earlier this year. He said that the government needs to deliver more supply and ensure the market is stable, as it is a huge part of the economy. He also highlighted Canada’s lack of affordable housing and championed Ottawa’s efforts to build out the supply of homes priced below market rates.

Mike Moffatt, founding director of the Missing Middle Institute, had a different answer when asked whether housing can be made more affordable for the average Canadian without a drop in market values. He said that it is simply not possible to restore broad-based affordability to the middle class without prices going down. In Canada, it would take 18 years to return to more affordable home price-to-income ratios, while in Ontario and British Columbia it would take roughly 25 years.

Prime Minister Mark Carney, who was asked the same question, asserted that he wants “home prices to be more affordable for Canadians.” He cited Liberal election campaign pledges to drop the GST on new homes and offer incentives to municipalities to cut development charges in half. The Liberals are looking to lower the cost of homebuilding with the aim of doubling the pace of housing starts in Canada. The government wants to scale up the use of prefabricated parts and other technological advances to streamline housing development.

Concordia University economist Moshe Lander agrees with Moffatt that home prices must come down if the government hopes to see broad affordability restored to the market over the next generation. However, he also questions whether the federal government should be the arbiter of housing affordability in the first place, given that so many of the political decisions are out of its control.

Lander said that any explicit government effort to bring housing prices down would be seen as an attack on homeowners’ equity, an asset many use to fund retirements or other long-term savings as they pay off their mortgages. At the local level, politicians tend to seek the support of homeowners because they tend to stay put in a riding or district. Most efforts to win renters’ votes tend to be “tepid” at best and “counterproductive” at worst.

Lander said part of the path to affordable housing has to be a shift away from the narrative that Canadians have been fed for generations — that home ownership is a lofty goal to aspire to and renters are “second-class citizens.”

Source: Financial Post