CREA Reports Home Sales Fell in February amid Tariff Uncertainty

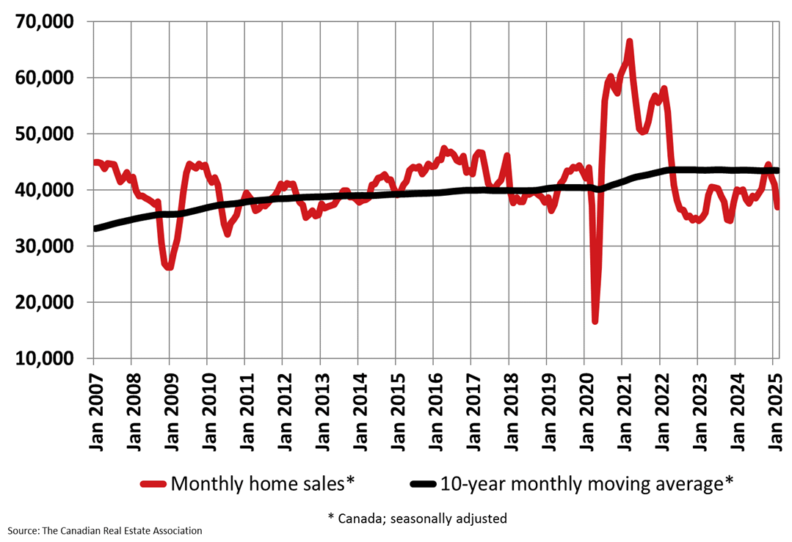

Home sales in February fell to their lowest level in over a year due to uncertainty caused by the US trade war. The Canadian Real Estate Association (CREA) reported that home sales were down 10.4% compared to the same month last year and 9.8% compared to January on a seasonally adjusted basis. The drop was the lowest level for home sales since November 2023 and the largest month-over-month drop since May 2022, when the Bank of Canada started aggressive rate hikes to fight inflation.

The pullback was not surprising given the political uncertainty brought on by the Donald Trump presidency, as people settled into a worried acceptance of the trade war as reality. Heavy winter storms hit the Toronto area and other parts of southern Ontario, weighing on sales, but it would have had only a minor effect on the month. Instead, it is largely uncertainty holding back sales, even as measures like savings and employment remain fairly strong.

The pullback in sales was most pronounced in the Greater Toronto Area, but it was fairly broad-based with declines in three quarters of local markets and almost all large markets. The association also reported that new listings fell 12.7% month-over-month, following a surprise increase in January. Total listings were up 13.1% from last year at around 146,000, but still below the long-term average for the time of year of 174,000 listings.

The actual national average sale price of a home sold in February was $668,097, down 3.3% from a year ago. Seasonally adjusted, the average price was down 4.6% from January. CREA’s own home price index fell 0.8% from January and was down 1.5% from last year. Price softness was most notable in the Toronto region, where the index fell 1.5% from last month.

The retreat on prices, combined with another interest rate drop from the Bank of Canada last week, is helping create buying opportunities for some. However, confidence in the housing market is likely to be under a cloud as the US keeps the threat of punitive tariffs alive.

Source: Star

Source: Globe and Mail

Source: Financial Post

Source: CREA

Annual Pace of Housing Starts in Canada Slowed 4% in February

Canada Mortgage and Housing Corp. (CMHC) reported a 4% slowdown in the annual pace of housing starts in February compared to January. The seasonally adjusted annual rate of housing starts was 229,030 units, down from 239,322 in January.

Single-detached home starts fell by 1% to 56,273 units, while all other housing starts dropped by 5% to 172,759 units.

The pace of starts for cities with a population of 10,000 or greater fell by 5% to 209,784 units. Rural starts were estimated at 19,246 units. The six-month moving average for the seasonally adjusted annual rate of housing starts in February was 239,382, up 1.1% from January.

Source: Star

Source: Globe and Mail

Source: CMHC

Building Permits, January 2025

In January, the total value of building permits issued in Canada decreased by 4.2% to $12.8 billion, with Ontario leading the decline and New Brunswick tempering it the most.

Residential construction intentions decreased by 3.4% to $8.8 billion, with the multi-family component declining by $424.2 million and the single-family component increasing by $111.4 million.

Ontario’s multi-family component led the decline, while New Brunswick (+$195.9 million) and Quebec (+$186.3 million) partially offset the losses.

Across Canada, 23,500 multi-family dwellings and 4,900 single-family dwellings were authorized in January, down 3.7% from the previous month but up 37.4% on a year-over-year basis.

The value of non-residential building permits decreased by 2.7% to $4.0 billion in January, with the industrial component driving the decline and the institutional component driving the decrease.

The commercial component (+$259.4 million) mitigated the decline in the non-residential sector. The declines in the industrial component were led by Ontario and Alberta.

Source: Statistics Canada