Fourth Quarter Housing Data Hints at Home Sales Rebound for 2025

December Highlights:

- National home sales fell 5.8% month-over-month.

- Actual (not seasonally adjusted) monthly activity came in 19.2% above December 2023.

- The number of newly listed properties dipped 1.7% month-over-month.

- The MLS® Home Price Index (HPI) climbed 0.3% month-over-month and was only down 0.2% on a year-over-year basis.

- The actual (not seasonally adjusted) national average sale price was up 2.5% on a year-over-year basis.

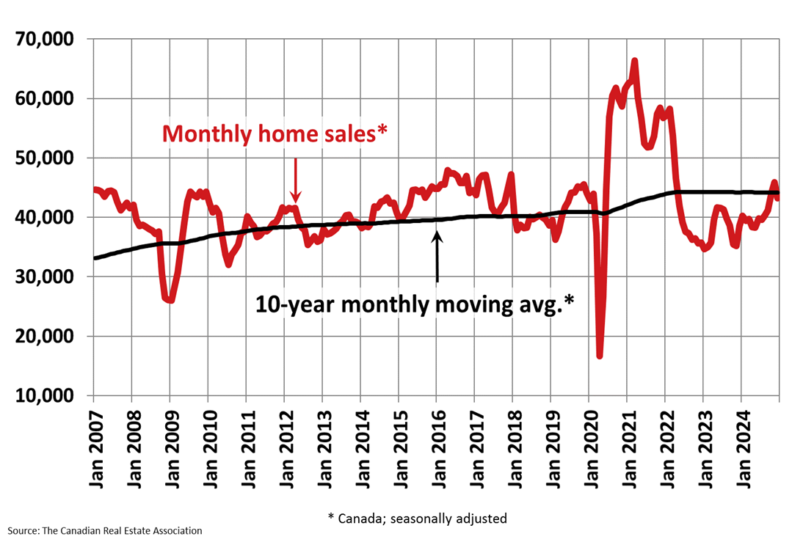

The Canadian Real Estate Association (CREA) predicts home sales to grow 8.6% this year, with a strong fourth quarter in 2024 indicating a rebound in most housing markets across the country. The association forecasts 532,704 residential properties will trade hands in 2025, a boost from last fall’s prediction of a 6.6% national increase in home sales. The national average home price is expected to rise by 4.7% annually to $722,221 compared to its earlier forecast of a 4.4% increase.

The Canadian Real Estate Association (CREA) predicts home sales to grow 8.6% this year, with a strong fourth quarter in 2024 indicating a rebound in most housing markets across the country. The association forecasts 532,704 residential properties will trade hands in 2025, a boost from last fall’s prediction of a 6.6% national increase in home sales. The national average home price is expected to rise by 4.7% annually to $722,221 compared to its earlier forecast of a 4.4% increase.

The CREA senior economist, Shaun Cathcart, believes that there is a record amount of demand waiting to come back, waiting for lower rates and inventory to be available. National home sales are forecast to climb a further 4.5% in 2026, with average home prices rising by 3.3% to $746,379. Lower borrowing costs are among the primary factors contributing to the improved outlook.

Home sales rose 10% in the fourth quarter of 2024 compared with the previous three months, marking one of the busiest quarters in the last 20 years, aside from the pandemic. The association expects interest rates to bottom out by spring and sellers to list properties in big numbers by then.

B.C. and Ontario, Canada’s two most expensive provinces for housing, are expected to see bigger sales rebounds this year along with larger inventories, but lower-scale price gains. Increased demand is expected to influence price increases more significantly in Alberta and Saskatchewan, where sales were already near record levels in 2024 and inventories are near 20-year lows.

CREA’s conservative forecast is due to the risks involved, such as a potential trade war with the U.S. that could damage Canada’s economy and push sales down.

Source: CREA

Source: The Star

Source: Financial Post

Source: Financial Post

CREA Updates Resale Housing Market Forecast for 2025 and 2026

The Canadian Real Estate Association (CREA) predicts a surge in demand from would-be homebuyers waiting for better deals, with interest rates expected to hit a bottom this year. Shaun Cathcart, CREA’s senior economist and director of housing data and market analysis, believes there is a record amount of demand on the sidelines. CREA forecasts an 8.6% increase in transactions across Canadian MLS Systems compared to 2024. However, the CREA is not anticipating a return to COVID-19-era levels of activity, as interest rates are not going to be as low, and prices are still much higher than they were before the pandemic.

In British Columbia and Ontario, where there is a lot of inventory and relatively high prices already, there is greater sales recovery but not much price growth unless buyers flood in and competition ramps up. In the Prairies, where inventory is at a 20-year low and sales are record high, CREA doesn’t anticipate much change, apart from price growth.

Mr. Cathcart was dour on the future for the condo market, where demand has waned amid a spike in new condo buildings coming on the market. He said condo owners are having trouble selling because many buyers prefer more spacious types of housing.

The number of homes that changed hands across the country in December was up 19.2 percent compared with a year earlier, as the Canadian Real Estate Association says a strong fourth quarter bodes well for a rebound in sales in 2025.

The CREA says the final three months of last year saw sales rise 10 percent from the third quarter, marking one of the busiest quarters in the last 20 years, aside from the pandemic.

CREA predicted the national average home price will hit $722,000 in 2025, up 4.7% from last year. One major caveat that could hinder sales growth is Canada’s trade war with the United States proceeds, which could have major economic consequences, including potential job losses, making it harder for people to pay their mortgages, and creating more uncertainty.

Canada is still short 3.5 million housing units to address the supply gap, while the Parliamentary Budget Officer places this figure at 1.3 million. The Conservatives’ pledge to eliminate the GST on new homes sold for under $1 million could help move the market, but they declined to comment on whether they might cut other housing programs if they win the next federal election.

Source: CREA

Source: Globe and Mail

Source: The Star

Source: Financial Post

Source: Financial Post

Total housing starts in Canada are up 2% in 2024 from 2023

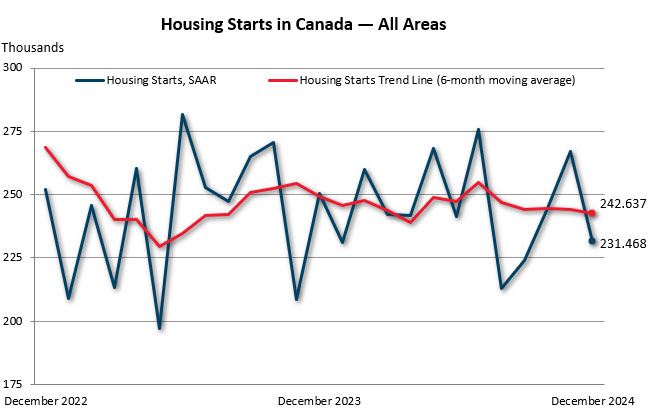

Canada Mortgage and Housing Corp. reported a 2% increase in housing starts in 2024 compared to 2023, with increased starts in Alberta, Quebec, and the Atlantic provinces.

The national housing agency said housing starts totaled 245,120 last year, up from 240,267 a year earlier. However, housing starts in Canada’s six largest census metropolitan areas saw a combined drop of 3% in 2024, as starts in Vancouver, Toronto, and Ottawa moved lower. Calgary, Edmonton, and Montreal saw an increase in starts last year.

The national housing agency said housing starts totaled 245,120 last year, up from 240,267 a year earlier. However, housing starts in Canada’s six largest census metropolitan areas saw a combined drop of 3% in 2024, as starts in Vancouver, Toronto, and Ottawa moved lower. Calgary, Edmonton, and Montreal saw an increase in starts last year.

Canada’s urban centres saw an uptick in housing starts in 2024 compared to last year, marking the third-highest year on record. The national housing agency has said Canada will require an additional 3.5 million housing units by 2030 to restore affordability to levels seen in 2004. It is estimated that Canada could be building up to 400,000 new housing units annually based on current resources devoted to residential construction.

A divide has started to emerge between Ontario and other parts of the country, as condo building is retreating under the weight of weak demand. Further declines in Ontario are likely on tap for this year, which, when combined with cooler population growth, point to a pullback in starts in 2025.

The seasonally adjusted annual rate for housing starts fell 13% in December to 231,468 units compared to 267,140 units in November. The acceleration in starts will be limited by the weakness in condo pre-sales.

Source: Globe and Mail

Source: The Star

Source: CMHC

Building Permits, November 2024

In November, the total value of building permits issued in Canada decreased by $739.5 million (-5.9%) to $11.7 billion, a second consecutive monthly decline. The residential sector led the decrease, followed by the non-residential sector. The total value of building permits issued in November declined 5.8% from the previous month and was up 2.1% year-over-year. Multi-unit construction intentions drove the decrease, with the multi-unit component contributing modestly to the decline.

Ontario’s non-residential construction intentions decreased by $151.4 million (-3.2%) to $4.5 billion in November, driven by Ontario (-$414.2 million). Gains in British Columbia (+$139.4 million), Quebec (+$111.9 million), Prince Edward Island (+$74.1 million), and four other provinces tempered the decline. Overall, the industrial component fell, while the institutional and commercial components increased.

Ontario’s industrial and commercial components decreased in November, contributing to the decrease in the province’s non-residential sector. The institutional component (+$117.8 million) tempered the decline.

In British Columbia, both the institutional and commercial components led the non-residential sector growth. Quebec’s non-residential sector was boosted by growth in the industrial component (+$201.5 million), driven by construction projects for a cathode active precursor materials facility in Bécancour and a large transit service centre in Québec. The commercial component (+$98.3 million) also supported Quebec’s non-residential sector.

Prince Edward Island’s institutional component (+$59.0 million) fueled the province’s non-residential increase.

Source: Statistics Canada

Young Canadians Are Losing Homeownership Hope

Canadians aged 18-44 are losing hope of homeownership being achievable in their lifetimes, according to a survey by Easy Home Renovation. Most Canadians believe homeownership is not a possibility in their lifetime, with only a small percentage of younger adults in Quebec, Newfoundland and Labrador, Saskatchewan, Nova Scotia, and Alberta believing they will own a home one day. However, less than 20% of those in Ontario and British Columbia believe it’s a possibility.

The report cited high rents, mortgage rates, and population growth as factors contributing to disillusionment among these generations. The lack of optimism in any city suggests that young people are changing their views on homeownership, with 63% of Millennials viewing homeownership as a primary goal compared to 53% of Gen-Zers. The housing crisis has also altered family plans for 27% of millennials and 26% of Gen Zers.

In April, the federal government announced a plan to address Canada’s housing crisis by creating 3.87 million new homes by 2031, including $15 billion in loans for apartment construction and extended mortgage amortization periods.

Source: Financial Post