Building Permits, June 2024

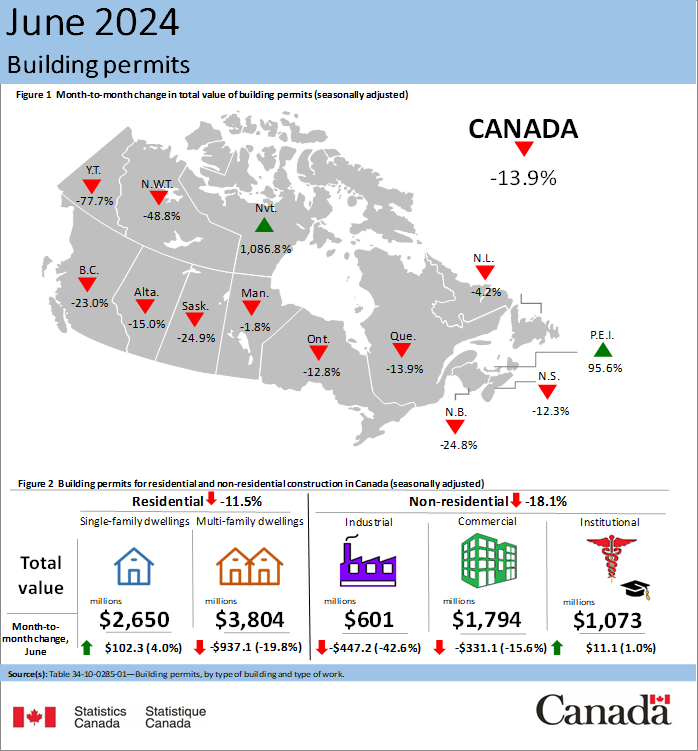

Canada’s total building permit value fell 13.9% to $9.9 billion in June, extending the decline from May. Decreases were reported in 11 provinces and territories, with both residential and non-residential sectors experiencing reductions. The total value of building permits declined 14.3% on a constant dollar basis.

Single-Family Dwelling Permits See Modest Growth amid Overall Residential Decline

Residential permits decreased 11.5% to $6.5 billion, with 9 provinces and territories contributing to the decline. Major declines in multi-unit construction intentions, particularly in Ontario and British Columbia, led to the decline. However, construction intentions in single-family homes increased by 4.0% to $2.6 billion. Canadian municipalities authorized 20,400 dwelling units in June, bringing the total to 263,400 units since July 2023.

Decline in Industrial and Commercial Construction Intentions Slows Non-residential Sector

The non-residential sector permits’ value decreased 18.1% to $3.5 billion, with the industrial component dropping 42.6%. Monthly declines in the commercial component outweighed gains in the institutional component, with a total value of $3.4 billion.

Ontario Drives Second Quarter Gains to a Record High in Multi-Unit Construction Intentions in Canada

In the second quarter of 2024, the value of building permits in Canada increased by 2.1% to $34.6 billion, marking the fourth highest quarterly value in the series. The residential sector experienced a 6.9% growth to $22.2 billion, driven by Ontario’s residential sector, which saw significant gains in the multi-unit component. This led to a national record of $14.4 billion, surpassing the previous all-time high of $13.2 billion in the second quarter of 2023.

The growth in the multi-unit component was primarily driven by significant permits issued in the City of Toronto. However, the total value of multi-unit residential building permits in Canada declined by 2.2% in the second quarter, with growth seen in seven provinces.

Across Canada, 70,200 residential units were authorized in the second quarter, a 9.1% increase from the first quarter. However, the non-residential sector experienced a 5.6% decrease in the second quarter, with the industrial component experiencing the largest decline.

Source: Statistics Canada

Bank of Canada Interest Rate Cut to Have Little Effect on Real Estate Market

The Bank of Canada has made a second consecutive key interest rate cut, but it won’t impact the real estate market in a “significant way,”. Experts believe that at least a full percentage point drop is needed to stimulate the market, which could be reached by the end of the year. Mortgage rates are still high for many people, and while the rate cut is welcome news, it won’t necessarily move the housing market in a significant way.

Fixed-rate mortgages, tied to the bond market, were already “meaningfully lower” than variable rates before the Bank of Canada’s second rate cut. A 0.25 percentage-point cut to variable won’t necessarily help affordability or bring in more buyers. The bond market is reading as “more dovish,” as the Bank of Canada is putting more weight on concerns about weaker economic growth and less on inflation pressure. Lowering interest rates can give a boost to the economy, keeping three- and five-year fixed mortgage rates on a downward-drifting path, albeit a gradual one.

While the rate cut won’t be enough to bring in an influx of buyers, it does help with buyer psychology, as Karen Yolevski, chief operating officer at Royal LePage, said that 18% of respondents would pursue buying property if the central bank dropped rates by 0.5 to 1 percentage point. Royal LePage is holding to its forecast of a 10% price increase from the fourth quarter of 2023 to the fourth quarter of 2024 in Toronto, with the forecasted aggregate home price in the final quarter of 2024 being $1,235,630, a more than $100,000 rise over last year’s actual final-quarter price of $1,123,300. Investors will need to see a bigger interest rate drop compared to end-users, who may be more likely to be affected by the rate cut.

Source: The Star

Canada’s Next Housing Crisis: Who Is Going to Build Millions of New Homes?

Canada’s federal government has set a goal to build 3.9 million new homes by 2031, two million more than projected, to boost the country’s expensive housing market. However, the construction industry faces labor shortages, with many nearing retirement age.

Between now and 2033, an estimated 134,000 residential construction workers will retire, but only 117,000 are projected to join the field. To restore affordability to levels seen in the early 2000s, the number of on-site construction workers would need to rise by 83% over the coming decade.

This is an outlandish vision given the current situation on the ground. The construction industry is among the loudest in discussing labour shortages, and companies must find skilled workers to build all these homes.

The immigration system is hardly used to recruit people in skilled trades, and some groups are seriously underrepresented in these occupations, notably women. Housing experts argue that the issue is less about the number of workers but how they are being used, an extension of the economy’s productivity woes. The Smart Prosperity Institute, a think tank based at the University of Ottawa, suggests that the country hasn’t changed how homes are built, and if anything, it has gotten even more labor-intensive.

In 2022, there were nearly 11,000 new apprenticeship registrations for construction electricians, an 18% increase from the 2010s, and 11,700 for carpenter apprenticeships, a 45 per cent increase. This indicates that efforts to support skilled trades are working.

The numbers show that women are severely underrepresented in skilled trades. Among working-age people from 25 to 64, women accounted for just 2.3 per cent of apprenticeship certificate holders in construction trades, according to census results for 2021. The same goes for racialized groups. In the working-age population, they made up 5.9 per cent of apprenticeship certificate holders in construction trades – well below their 27-per-cent share of the 25-to-64 population.

Canada’s construction industry saw a meagre inflow of immigrants last year, with around 13,800 aiming to work in skilled trades, accounting for 2.9% of total permanent resident admissions. Canada’s points-based economic immigration system primarily targets high-wage, white-collar professionals, which is beneficial for raising wages but less effective in solving housing issues.

Canada’s housing sector is not keeping pace with the country’s potential capacity to build over 400,000 homes annually, despite more people working on housing projects and more money flowing into them. The country has notched 252,000 annualized starts in the first quarter of this year. The productivity issue is attributed to red tape in permitting processes, restrictions on what can be built where, and most construction companies having fewer than five employees.

Consolidation may help generate economies of scale, making the math work better to build affordable housing and enabling some production savings to be passed on to Canadians. However, Mr. Moffatt of the Smart Prosperity Institute is more concerned about money than labour, stating that if Canada aims to build an additional two million homes, it would require $1-trillion in capital.

Source: Globe and Mail

Nearly 40% of New Canadians Are Considering Moving Due to Housing Costs

Canada has experienced record levels of immigration in recent years, but housing costs continue to rise, making many Canadians consider leaving their province of residence due to housing unaffordability. A recent poll from the Angus Reid Institute found that about two-in-five recent immigrants are seriously considering leaving their province of residence due to housing unaffordability.

This comes amid a growing flood of Torontonians abandoning Ontario’s capital for more affordable pastures, with 220,000 more Canadians leaving the city in the past two years than arrived. An average 28 per cent of Canadians say they’re seriously considering leaving their province of origin over steep housing costs, with the sentiment felt strongest in Ontario (39%) and British Columbia (38%), provinces with some of the priciest properties in Canada.

More people are thinking of leaving in Toronto than any other major city in Canada, with 44% of people in its core and outskirts strongly considering a move. The city now has a record number of condo units for sale, the majority owned by investors, while it faces an escalating homelessness and housing crisis. Canada-wide, the sentiment is felt strongest among 18 to 24-year-olds, with 42% of them mulling a move.

Source: Financial Post

Toronto’s New Condo Sales Plunge 57%, Hit 27-Year Low in ‘Catastrophic’ Drop

New condominium sales in the Greater Toronto and Hamilton Area have slowed to levels not seen in 27 years, according to a report by Urbanation. In the first half of 2024, only 3,159 new condo units were sold, down 57% from the same time a year ago and 72% below the 10-year average.

Most unsold units were pre-construction, with most being unbuilt. Mortgage broker Ron Butler described the sales decline as “catastrophic” as buyers cannot afford the small, pricey condos for sale. Despite this, condo prices have only slipped 2.6% over the past year due to developers refusing to take a financial hit due to high interest rates.

Developers are also wary of starting new projects, offering only 3,625 new pre-construction units in the second quarter, compared to 7,349 units the same time last year. Of those, only 17% sold. However, prices might start to fall in the GTA in the near term as the Bank of Canada appears to be on a downward interest-rate path.

In the second quarter, 1,688 new condo units were sold, down 66% in a year. The small units are another reason condos aren’t selling, as developers struggle to cope with high development fees and taxes. Only 727 new condo units started construction in the second quarter, a more than 20-year low.

Developers aren’t building, which means that supply will shrink in a few years. To keep up with increasing demand for housing, the GTA would need 40,000 units to be completed per year. Project completions are expected to continue trending downward for the rest of the year.

Source: The Star

Why Toronto’s Stalled Condo Market Will Make the City’s Housing Shortage Even Worse

Toronto’s real estate market is facing a significant housing shortage in the coming years, despite the current glut of condo listings. Construction starts are trending less than 10,000 for the current year, and the city needs around 30,000 to 40,000 units a year to satisfy population growth.

In 2027, only 23,900 condos and purpose-built rentals are projected to be completed in the Greater Toronto and Hamilton-area, a 10,000 unit decline from 2024. This is due to a fundamental supply shortage in Toronto, which cannot meet existing targets due to high interest rates and development fees.

The market is also facing a misconception that there is too much inventory, as low interest rates during the pandemic led to a wave of pre-construction buyers entering the market. Pouyan Safapour, president of real estate developer Devron, believes that studio and one-bedroom apartments are better for investors than end-users, feeding into the idea that there are too many condo units.

Toronto’s condo market has seen a significant decline in recent years, with around 56% of condos built since 2016 owned by investors. However, many investors have exited the market due to rent being unable to cover mortgage costs, condo fees, and property taxes. Condos have also become less attractive for investors as prices have dipped. End users are also on the sidelines due to high interest rates and borrowing costs, but those who can buy aren’t interested in studio or one-bedroom properties.

New listings in Toronto’s condo market surged by 26.5% in the second quarter of 2024 compared to the same time last year, while sales dropped by almost 20%. However, the ample supply on the market will be short-lived once interest rates reach more affordable levels. The dramatic slowdown in pre-construction sales and construction during this period will reverberate, with the percentage of pre-construction condos that are pre-sold at a more than 20-year low of less than 50%.

Developers are wary of starting new projects, offering only 3,625 new pre-construction units in the second quarter, compared to 7,349 units the same time last year. Only 17% of those units have sold. Canceled projects will lead to a shortage in tens of thousands of units in years to come, experts warn.

During the pandemic, assignment flippers and mom and pop investors flooded the market hoping to get a good return on their unit. Now, buyers in the pre-construction market are a mix of investors who have access to capital and end-users who can afford the high cost of pre-construction units. A flood of units has entered the assignment sale market, but as interest rates drop, the number of units up for assignment sale will also drop.

Once more buyers jump into the condo market, competition will heat up and prices edge upwards. That will signal to developers demand is on the rise and construction starts will ramp up, but they’ll likely build smaller units favoured by investors due to their chances of being cash flow positive, not the two- to three-bedroom apartments end-users and renters desire, which means the city’s housing crunch won’t be any better off.

Source: The Star