- COVID Lock-downs did not lead to Supply Chain disruptions or inflation.

- Diversification is dead before it started.

- Reasons for inflation were all short-term.

- Foreign Exchange will affect sales in 2023.

It is impossible to discuss product sales without first considering the current economic environment.

For three years businesses have been talking about and blaming COVID, transportation and inflation for their business woes. For many products this simply is not true.

Canadian imports of Small Appliances and Houseware (quantities) increased in 2020 and 2021 but decreased in 2022.

Problems were due to increased demand far in excess of 2019 levels

The numbers show that neither Small Appliances nor Houseware volumes were adversely affected by COVID Lock-downs or Supply Chain Disruptions. Many products experienced historical highs in 2020 and 2021 in spite of lock-downs and transportation problems.

Problems were exasperated by commercial buyers issuing ever-increasing orders in anticipation of even higher demand. Unfortunately, the higher demand was not long lived resulting in current excess inventories with bloated values due to early 2022 transportation costs.

2023 Forecasts Import Reports “Importers, manufacturers and shipping companies use trade statistics to monitor import penetration and, identify market opportunities, monitor commodity price and volume changes, and examine transport implications of trade flows.” Stats Can

Transportation and labour could not keep up with demand.

2023 Forecasts Import Reports “Importers, manufacturers and shipping companies use trade statistics to monitor import penetration and, identify market opportunities, monitor commodity price and volume changes, and examine transport implications of trade flows.” Stats Can

These past and current challenges have led firms to rethink their global sourcing strategies, including re-shoring or near-shoring parts of the production process and increasing the inventory of critical goods.

However, restructuring supply chains is costly. Building new factories is fairly straightforward compared to re-drawing global shipping for raw materials and finished products.

[China has seven of the world’s top 10 container ports, plus 400 smaller ones. State owned COSCO Shipping is the world’s biggest shipping company. China is also the world’s leading shipbuilder. China produces more than 96 per cent of the world’s dry cargo containers and 100 per cent of temperature-controlled containers.]

But the greatest challenge to diversification is China’s economy. China has no inflation; export prices over the past 4 years are flat and wage growth is controlled. China managed economy also ensures that their exchange rate fluctuate with the US dollar.

How do countries who are experiencing 5% – 10% inflation, aggressive wage demands and falling exchange rates compete with China who has none of these problems?

Consumers and retailers all want lower prices. It would be political suicide to increase import duties during an inflationary period. After inflation is tamed and supply and demand is balanced, we will just continue on with short-term problems and forget diversification.

Reasons for inflation were short-term

The compounding effect of lock-downs, lower production, shift in spending away from entertainment and leisure, and catch-up demand and buyers response resulted in inflation. Lower inflation will eventually result in lower interest rates, but wage demands will continue until buyer equity returned. Prices will never go back to 2019 levels. Nor should they.

The Bank of Canada’s inflation target is 1 to 3% annually. Businesses should use similar multi-year CDN $ product price targets. If products are priced in USD, USD/CAD exchange rate will still affect shelf prices.

Foreign Exchange will affect sales

The U.S. dollar is the world’s dominant reserve currency, held by central banks in significant quantities around the world. It is widely used to conduct international trade and financial transactions eliminating the costs of settling transactions involving different currencies. The demand for the dollar as a reserve currency by countries and companies results in a stronger U.S. dollar.

If products are priced in USD, USD/CAD exchange rate will still affect shelf prices. Whether the importer or retailers sells Canadian dollars to import goods in US dollars the rate will affect shelf prices and sales.

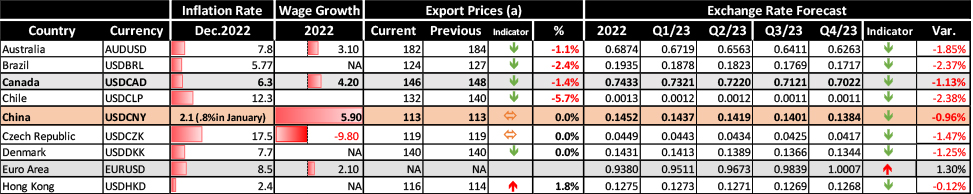

· The US dollar is forecasted to appreciate against all other currencies in 2023.

· Canadian exchange rate is forecasted to fall 1.18% in 2023 to .72 – .73 USD.

· Most currencies will decline against the USD in 2023 by less than 2.5%.

· Exceptions: Russia declines by 6.3% while the Euro and Pound will appreciate by 1.3% and 1.8% respectively after a disastrous 2022.

Planning

Start your planning with high level economic factors and forecasts. You will not significantly beat these factors without an exceptionally good reason.

Small Appliances

Data Sheets: Economic factors by country, detailed 2019 quantities and Unit costs (USD) and 2023 forecast by country are available for download by members.

- China manufactures more than 80% of all small appliance imported into Canada.

- China’s unit costs (USD) are essentially unchanged from 2019.

- Unit Cost can vary dramatically from country to country. This is due to quality/ price point rather than production costs and other economic factors. Note: Regardless of an individual countries inflation, wage and FX challenges, unit costs in USD remain flat.

- 2023 forecast (a) increases for quantities and unit costs are less than 5%

- Lower volumes from China are primarily due to lower demand than increases in other countries.

- Increases volumes for specific products in other countries are rarely significant or consistent.

Exceptions:

- Ultrasonic Vaporizer volumes doubled in 2021 and continue to grow.

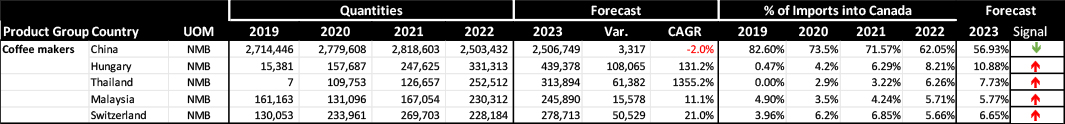

- Coffee makers: There has been a significant and consistent move to Hungary, Thailand, and Malaysia.

- Mexico has become a significant competitor for Ceiling & Roof Fans

Data Sheets

“Importers, manufacturers and shipping companies use trade statistics to monitor import penetration and, identify market opportunities, monitor commodity price and volume changes, and examine transport implications of trade flows.” Stats Can

Excel data sheets are available for download by members. Sheets cover 64 countries and quantities and Unit costs for 30 products. See samples below.

If you are a CHPTA member and are interested in accessing the CHPTA Resource Library to view valuable industry reports such as this one, please email Michael Jorgenson at mjorgenson@chpta.ca.

Economic Factors

Economic Factors 2

Quantities

Unit Cost (USD)

Reports will be issued for other categories in the coming weeks.

Questions or comments: Bob Smith rsmith@chpta.ca or Sam Moncada smoncada@chpta.ca

“Importers, manufacturers and shipping companies use trade statistics to monitor import penetration and, identify market opportunities, monitor commodity price and volume changes, and examine transport implications of trade flows.” Stats Can