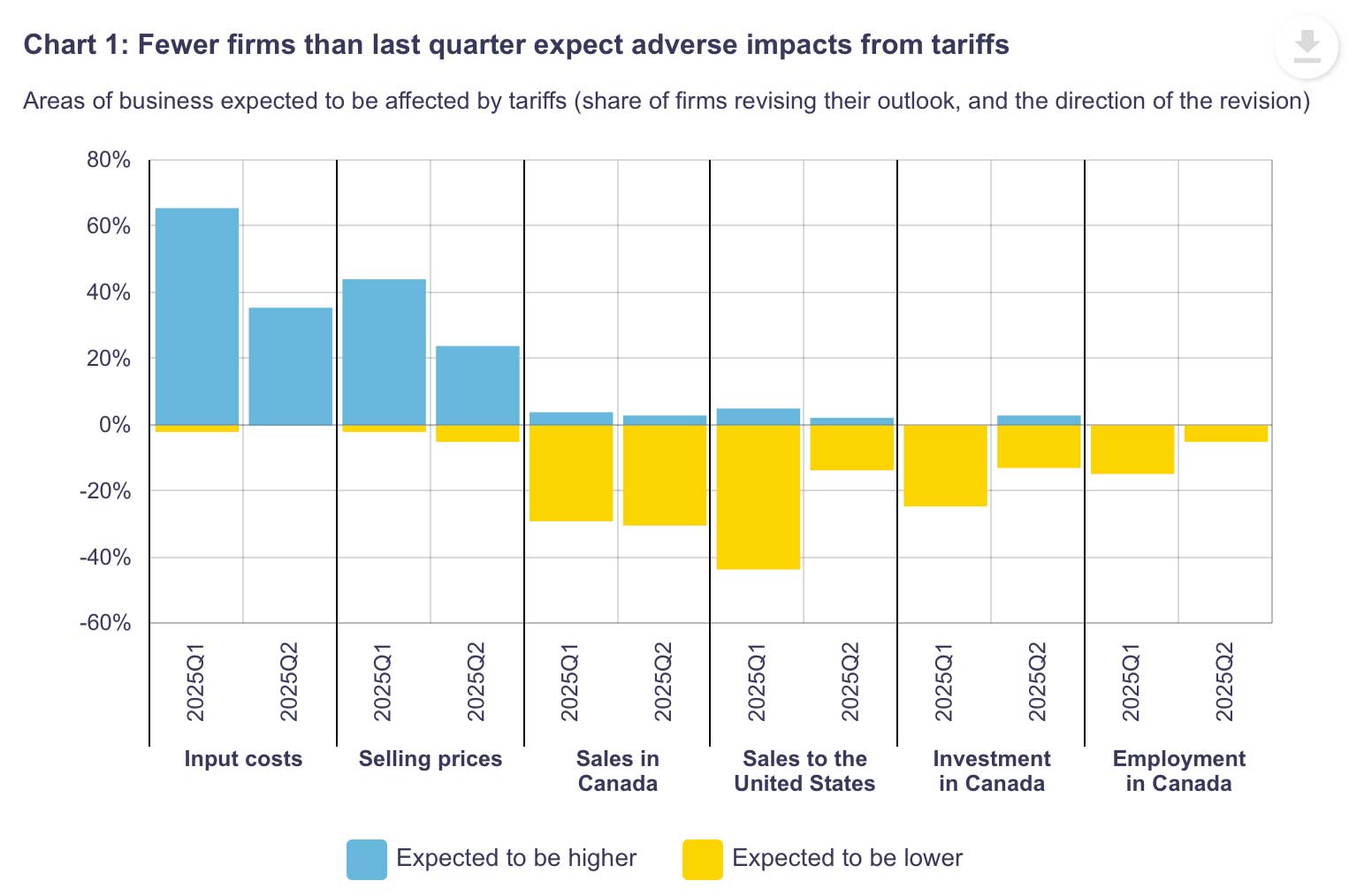

Canadian businesses and consumers are experiencing a chill due to U.S. President Donald Trump’s erratic trade policy, according to two Bank of Canada surveys published in late April and May. The surveys revealed that Canadian companies are curtailing investment and hiring and eating higher tariff-related costs due to weak consumer demand. Consumers are worried about their jobs and are delaying big purchases. However, the surveys found a sense of relief that U.S. tariffs have not bitten as hard as many feared earlier in the year when Trump threatened across-the-board tariffs without the exemptions that were later introduced.

Canadian businesses and consumers are experiencing a chill due to U.S. President Donald Trump’s erratic trade policy, according to two Bank of Canada surveys published in late April and May. The surveys revealed that Canadian companies are curtailing investment and hiring and eating higher tariff-related costs due to weak consumer demand. Consumers are worried about their jobs and are delaying big purchases. However, the surveys found a sense of relief that U.S. tariffs have not bitten as hard as many feared earlier in the year when Trump threatened across-the-board tariffs without the exemptions that were later introduced.

The Bank of Canada said that fewer businesses are considering extremely negative scenarios in their planning. This hint of optimism was reinforced by the central bank holding interest rates steady for the third consecutive time.

What happens to monetary policy going forward depends on how the trade war unfolds—both the outcome of Ottawa’s trade negotiations with Washington and how tariffs end up feeding through Canada’s economy and influencing business pricing decisions and consumer behaviour. Since May, Trump has doubled tariffs on steel and aluminium to 50% and increased tariffs on goods that don’t meet free-trade-agreement rules to 35% from 25%.

The surveys highlight several dynamics that could inform where interest rates go from here. So far, U.S. tariffs and Canadian counter-tariffs haven’t had a major impact on Consumer Price Index inflation, which came in at 1.9% in June—below the central bank’s 2 percent target.

Business and consumer expectations about future inflation remain elevated, although they did level off somewhat in the second quarter. While central bankers did not ease monetary policy, there is ample scope for them to resume their cutting cycle later in the year should the economy continue to stagnate.

Source: Globe and Mail

Source: The Star

Source: Bank of Canada