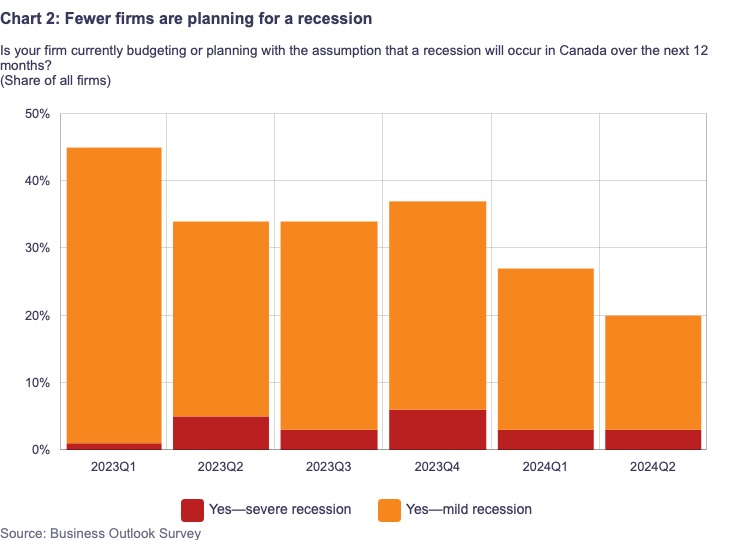

A pair of Bank of Canada surveys published on July 15th suggest that businesses and consumers in Canada expect the Canadian economy to remain stagnant and inflation to continue to decline. The bank’s quarterly survey of businesses found subdued expectations for future sales, easing cost pressures tied to wages, and little interest in hiring or investing in machinery and equipment.

This pessimistic view is influencing how much companies plan to raise prices and their forecasts for inflation. The Bank of Canada said that businesses expect the growth of their input and selling prices to slow, suggesting that inflation will continue to decline over the coming year. Individual expectations for near-term inflation also declined significantly, according to the bank’s consumer survey.

A business survey in Canada revealed that many companies expect weak sales, particularly in discretionary goods and services, and are hesitant to invest in equipment or hire new workers. The survey also highlighted a rise in companies citing taxes and regulation as their top concerns.

The bank cited weak demand, elevated interest rates, uncertainty about the business environment, and the high cost of machinery and equipment as discouraging investment. However, the economy is beginning to rebalance after a period of extreme disruption.

Fewer firms are experiencing supply chain problems, and the share of companies reporting labor shortages has fallen sharply. Business expectations about future wage increases are approaching pre-pandemic norms, as unemployment has risen to 6.4% from a 2022 low of 4.8%.

Slower wage growth would be beneficial for businesses trying to control costs and central bankers trying to control price increases, but not for workers hoping to catch up with inflation. The consumer survey also revealed strain among individuals and households, with most reporting cutting back on spending and remaining pessimistic about the future of the economy.

Source: The Star

Source: Globe and Mail

Source: Bank of Canada