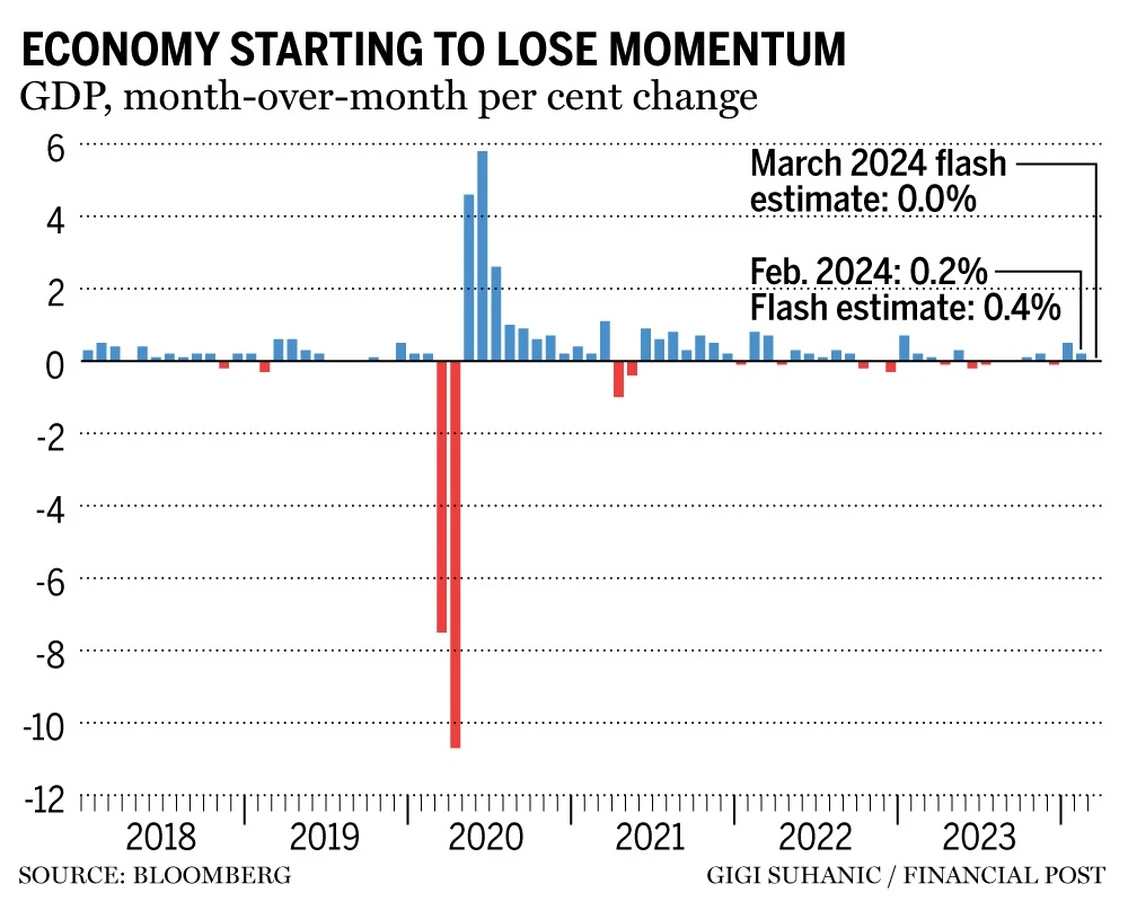

The Canadian economy experienced a slowdown after a strong start to the year, indicating that the Bank of Canada is on track to cut interest rates in the coming months. Statistics Canada reported a 0.2% real GDP increase in February, following a 0.5% gain in January. This data supports the idea that the growth is sluggish as higher interest rates impact consumer and business spending decisions. The Bank of Canada is looking for evidence that the economy and inflation are responding to tighter monetary policy.

Governor Tiff Macklem said last month that the central bank is seeing the right conditions to begin lowering its policy rate from 5%, but he wants to see those conditions sustained to ensure inflation is heading down to the bank’s 2% target. The loss of momentum in the quarter puts additional pressure on the BoC to begin cutting as soon as June. “Today’s GDP report confirmed our expectations that the January surge in output was temporary,” Royal Bank of Canada economist Claire Fan said in a note on April 30th.

Governor Tiff Macklem said last month that the central bank is seeing the right conditions to begin lowering its policy rate from 5%, but he wants to see those conditions sustained to ensure inflation is heading down to the bank’s 2% target. The loss of momentum in the quarter puts additional pressure on the BoC to begin cutting as soon as June. “Today’s GDP report confirmed our expectations that the January surge in output was temporary,” Royal Bank of Canada economist Claire Fan said in a note on April 30th.

The labour market also shows sluggishness in the Canadian economy, with job creation lagged population growth. In March, the unemployment rate jumped to 6.1%. However, a June rate cut still depends on April inflation data, which are set to be released in a few weeks.

Statistics Canada’s report shows 12 of 20 sectors showed growth in February, with services-producing industries increasing 0.2%, transportation and warehousing sector increasing 1.4%, and air transportation increasing 4.8%. Goods-producing industries were essentially unchanged. The mining, quarrying, and oil and gas extraction sector grew 2.5% in February, while the utilities sector contracted 2.6%.

The manufacturing sector declined 0.4% in February, driven by declines in transportation equipment manufacturing and chemical products manufacturing. Transportation equipment manufacturing contracted 2.9% as six of seven industries comprising the sub-sector were down. Motor vehicle and parts manufacturing was the largest contributor to the decline, as shutdowns for retooling activity continued to impact production. Gains in machinery manufacturing (+2.5%) and computer and electronic product manufacturing (+5.1%) tempered the decline in the overall sector.

Source: Globe and Mail

Source: The Star

Source: Financial Post

Source: Statistics Canada